20+ Ltv ratio calculator

Or enter C and D to find A and B. LTV mortgage balance home value x 100.

What Is An Amortization Schedule Use This Chart To Pay Off Your Mortgage Faster

You can use a mortgage loan-to-value calculator to determine the cumulative LTV you are eligible for.

. For example if youre buying a property worth 250000 and have a deposit of 50000 youll need to get a mortgage. For instance lets assume you own a home that costs 300000 and your current mortgage balance was 240000. Our Loan to Value LTV Calculator is easy to use.

If you get an 80000 mortgage to buy a 100000 home then. For example if youre buying an. Loan amountappraised value of asset x 100 LTV For example if you.

This ratio calculator will accept integers decimals and scientific e notation with a limit of 15 characters. An additional loan of Rs20 Lakh increases the loan-to-value ratio to 625. Down Payment 80000.

You only have to enter two. Loan to Value LTV Calculator. A LTV to CAC ratio of 11 means it costs you as much to.

An LTV over 100 means you owe more on the loan than your. The LVR formula is calculated by dividing the loan by the propertys value. That means your LTV is 80 percent and your deposit is 20.

LTV is the reciprocal. Enter your estimated home. LTV is based on the.

Loan-To-Value Ratio - LTV Ratio. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. You need to divide 200000 by 250000 to find out what your LTV is.

This online calculator is ideal for use with both home mortgage purchase and home mortgage refinance plans. The loan-to-value ratio commonly referred to as LTV is a comparison of your cars value to how much you owe on the loan. The loan-to-value ratio is the amount of the mortgage compared with the value of the property.

You can use this Loan to Value Calculator to calculate the loan-to-value LTV and cumulative loan-to-value CLTV ratios for your property. The remaining 20 must be paid out of your pocket. You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or.

In this case thats 480000600000 which makes the loan to value ratio 80. By determining your LTV to CAC ratio youre essentially determining how efficient your new customer acquisition channels are. Enter A and B to find C and D.

To calculate your LTV. Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home. The resulting number is your loan to value ratio shown as a percentage.

To calculate your LTV ratio using Microsoft Excel for the example above first right click on columns A B and C select Column Width and change the value to 30 for each of the. If you put 20 down on a 200000 home that 40000 payment would mean the home still has 160000 of debt against it giving it a LTV of 80. Current combined loan balance Current appraised value CLTV.

On a 500000 home only 15000 5000003 is. Our Loan-to-Value LTV Ratio Calculator helps you estimate how much you owe on your mortgage compared to your homes current market value. This is equal to 08 which is 80 when multiplied by 100.

Then multiply the result by 100 to express the LTV as a percentage. Mortgage Loan 320000. The formula to calculate LTV is.

See the results for Free refinance calculator mortgage in Agawam. The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a. Conventional mortgages can allow for an LTV ratio of up to 97 or a downpayment as low as 3.

The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. It is expressed as a percentage.

Customer Lifetime Value An Ultimate Guide

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Customer Lifetime Value An Ultimate Guide

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

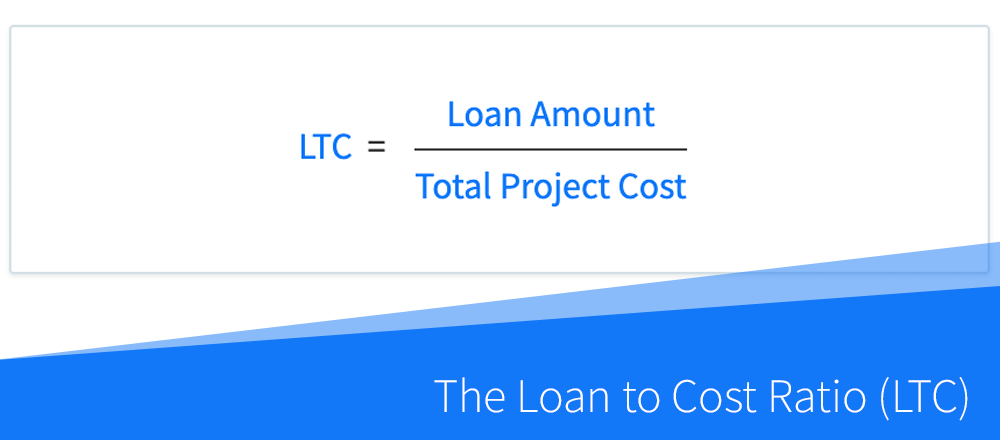

Loan To Value Ratio Ltv Formula And Example Calculation

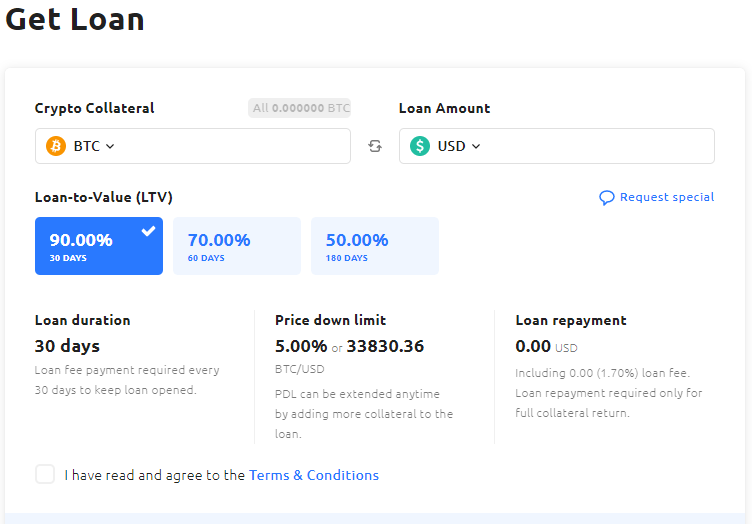

5 Best Bitcoin Loan Sites Reviewed 2022 Updated

Loan To Value Ratio Ltv Formula And Example Calculation

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Dealcheck Blog Dealcheck

How To Calculate The Debt Yield In Commercial Real Estate Dealcheck Blog

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

Ltv Cac Ratio 2022 Guide Benchmarks Formula Tactics Daasity

How To Automate Approvals 20 Free Approval Process Templates Process Street Checklist Workflow And Sop Software

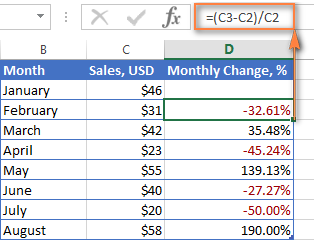

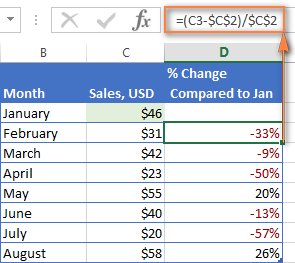

Calculate The Loan To Value Ltv Ratio Using Excel

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Percentage In Excel Percent Formula Examples

Customer Lifetime Value An Ultimate Guide